The financial services industry has come a long way in terms of accessibility and customer communication.

Mobile apps have revolutionized how customers interact with financial institutions, and the industry is currently using a suite of powerful tools and platforms to reach out to their customers through various communication channels.

But there's a significant gap. Despite heavy investments in digital transformation, financial institutions still rely on basic SMS for crucial customer notifications and alerts. This messaging gap doesn't just affect customer engagement – it impacts security, compliance, and operational efficiency.

RCS (Rich Communication Services) offers a strategic solution to bridge this gap. It enables financial institutions to deliver secure, interactive messaging experiences through customers' default messaging apps, combining the universal reach of SMS with the rich features of modern messaging platforms.

Let's explore how RCS is transforming banking communication and how you can implement it effectively.

How RCS enhances your current SMS experiences

Let's look at a few common scenarios and compare SMS with RCS to understand how RCS enhances customer communication.

1. Fraud Alerts

With SMS, you'd get a message like this:

"ALERT: Unusual transaction detected on your card ending 4321 for USD 500 at Amazon. Reply YES to confirm or NO to decline."

With RCS, you get:

- A branded message with your bank's logo

- Clear transaction details with merchant info

- Simple "Confirm" or "Block" buttons

- An option to freeze your card instantly

- A direct link to report fraud

2. Payment Reminders

With SMS, you’ll receive the following message:

"Your credit card payment of INR 25,000 is due in 3 days. Please pay to avoid charges."

But, with RCS, you’ll see the following:

- A visual breakdown of what you owe

- Quick payment buttons

- Your payment history in a simple scroll

- Easy auto-pay setup

- One tap to see your full statement

3. Loan Updates

Before RCS, loan updates were messy. You'd get emails, SMS, and calls.

Now with RCS, you get:

- A visual tracker showing your application status

- Easy document uploads

- Quick answers to your questions

- Instant updates at each stage

- Simple scheduling for virtual meetings

Getting Started with RCS

Successful RCS implementation requires a methodical approach that aligns with your institution's strategic objectives. Here’s what you should do if you’re thinking about implementing RCS into your customer communication strategy:

Do an infrastructure audit: Talk to your tech team and ask them to do a thorough audit of your current customer communication infrastructure. This assessment should examine message volumes, delivery rates, and customer engagement patterns across all channels.

Develop a prioritization framework: Understand what type of messages you want to move to RCS first. Evaluate this based on business impact and implementation complexity. High-volume, customer-critical communications often provide the most immediate returns. Focus initially on scenarios where interactive features can significantly reduce friction and support costs.

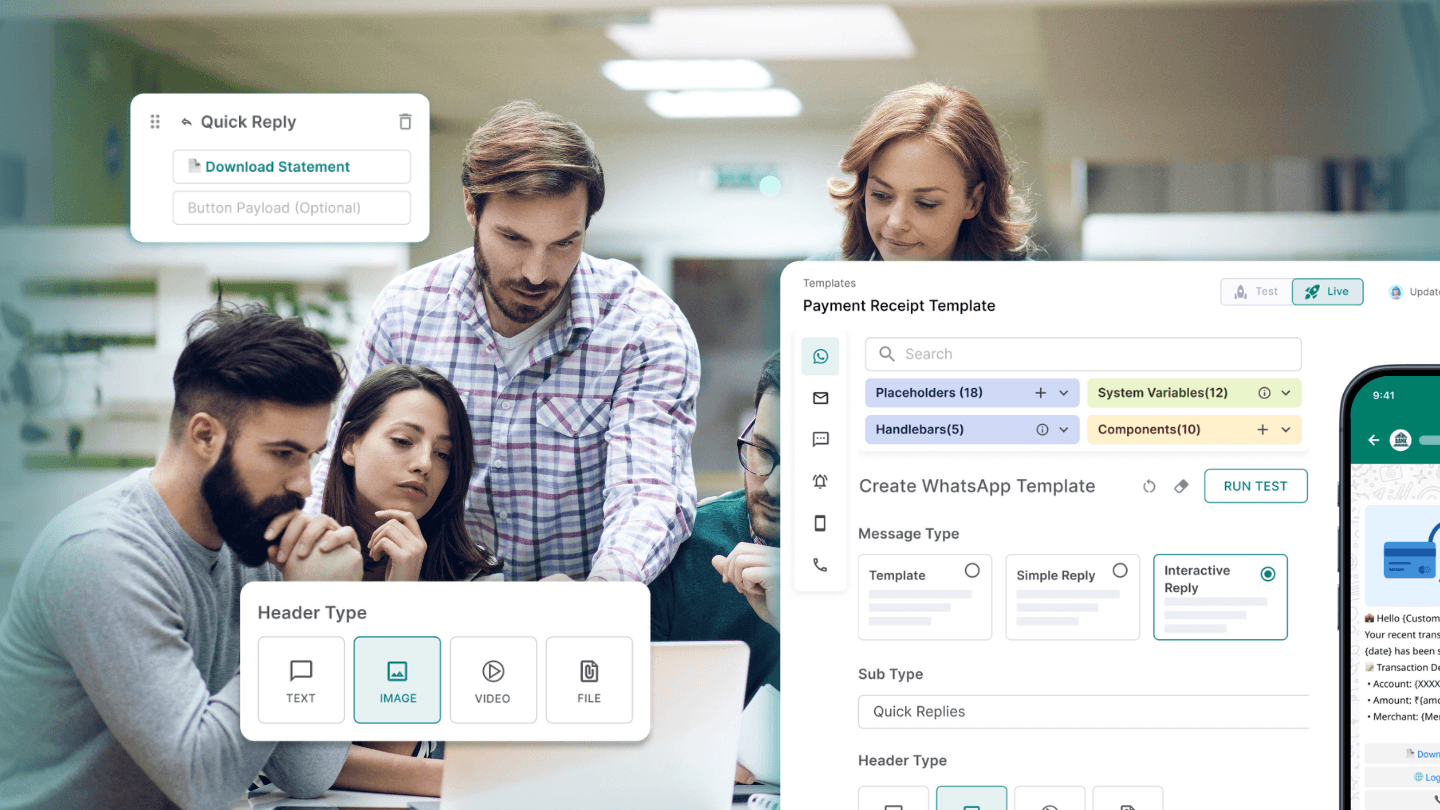

Create templates and workflows: Work with your engineering team to create the necessary templates and workflows to send the prioritized RCS messages. You can also use platforms like Fyno to manage all your templates and workflows without touching your cosebase.

Do a phased roll-out: Implementation should follow a controlled rollout strategy. Start with a defined customer segment and expand based on performance metrics and operational readiness. This approach enables real-time optimization while ensuring systems can effectively handle increased message volumes.

We've also built a detailed checklist to help you with your RCS readiness. Do check it out.

How can Fyno transform your RCS implementation

As a complete customer communication platform, Fyno is designed to help financial institutions unlock the full potential of RCS while minimizing implementation complexities. Here's how:

Seamless RCS integration

Connect your RCS provider (and other channel providers) to Fyno and link it with your existing systems through our unified API. No need to rebuild your notification infrastructure or manage multiple integrations. Your engineering team can focus on core product features while we handle the messaging complexity.

Intelligent channel orchestration

Never worry about message delivery again. If an RCS message fails to deliver, Fyno automatically switches to SMS or other channels based on customers preferences. This ensures that critical communications always reach your customers.

Banking-grade security

Built specifically for financial institutions, Fyno's platform includes end-to-end encryption, audit logging, and role-based access control. This helps you maintain compliance while protecting sensitive customer data in all RCS communications.

Centralized template management

Our template editor lets your team design rich, interactive banking messages - from fraud alerts to loan updates - without depending on technical resources. This means faster deployment and easier testing of new message templates.

Performance analytics

Track how your RCS messages perform compared to other channels. Our analytics dashboard shows delivery rates, engagement metrics, and customer interaction patterns. Use these insights to optimize your messaging strategy and demonstrate clear ROI.

Future-Proofing Your Implementation

The future of banking communication goes beyond just adopting RCS. It's about building a flexible foundation that can evolve with changing customer preferences and new messaging technologies.

Fyno helps you stay ahead by:

- Automatically supporting new RCS features as they roll out

- Enabling quick testing of different message templates and take them live within minutes

- Providing insights to help you understand which messaging approaches work best

- Maintaining compliance by honoring user preferences and sending messages through your users' preferred communication channels.

Remember, successful RCS implementation isn't just about the using the technology - it's about delivering better communication experiences that build trust and engagement. With the right platform and approach, you can transform your customer communications today while being ready for whatever comes next.

Ready to enhance your banking communications with RCS? Let's talk about how Fyno can help you get started.