Imagine this: A customer attempts to make a high-value digital payment, but it fails. Instead of just sending a standard failure notification, an AI agent springs into action.

The agent instantly analyzes the cause for the failure, notices that it is due to a transaction limit issue, and crafts a contextual notification.

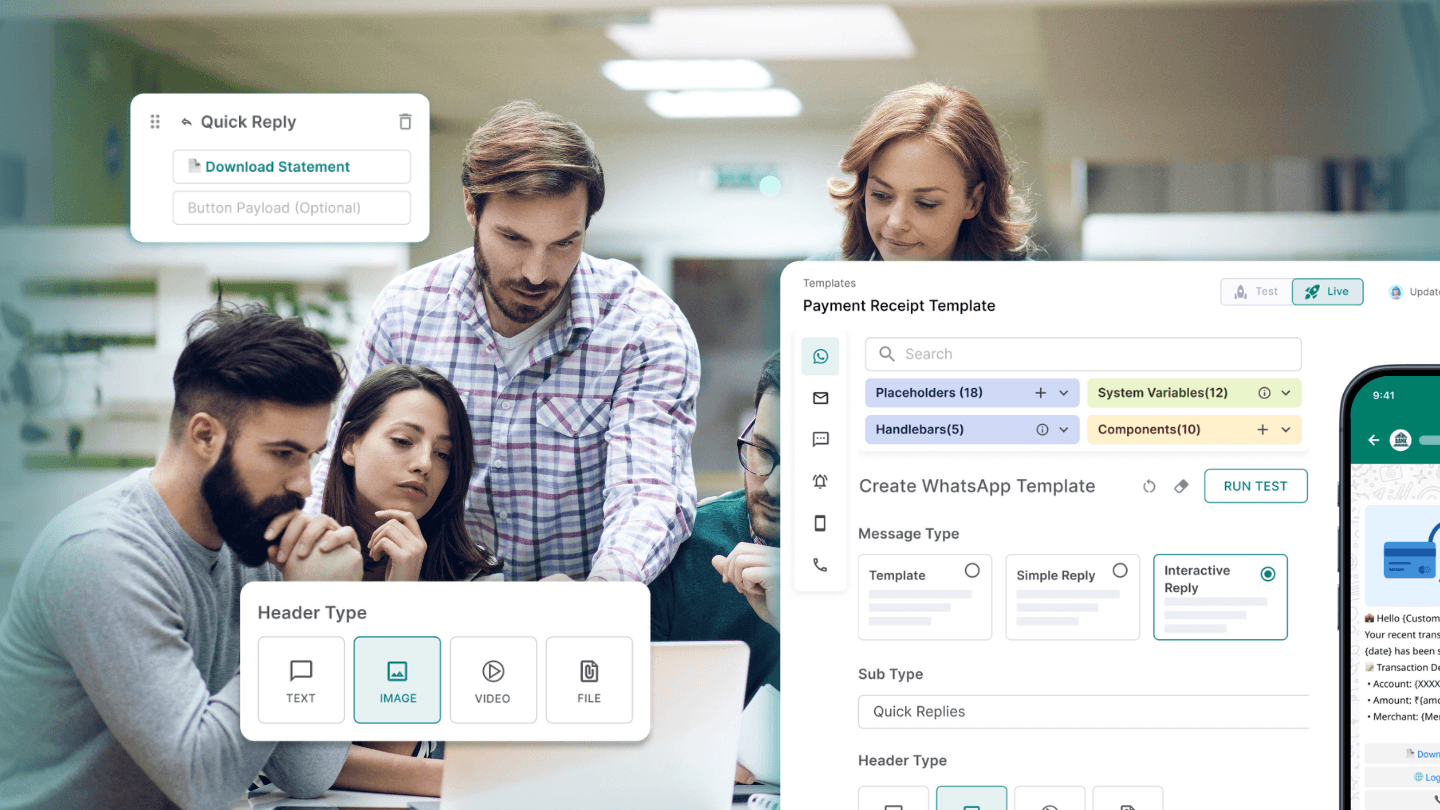

It then checks the customer's preferred channels and sees that they respond best to WhatsApp during work hours. Within seconds, the customer receives a clear WhatsApp message explaining the limit issue, followed by a guided workflow to help them increase their transaction limit.

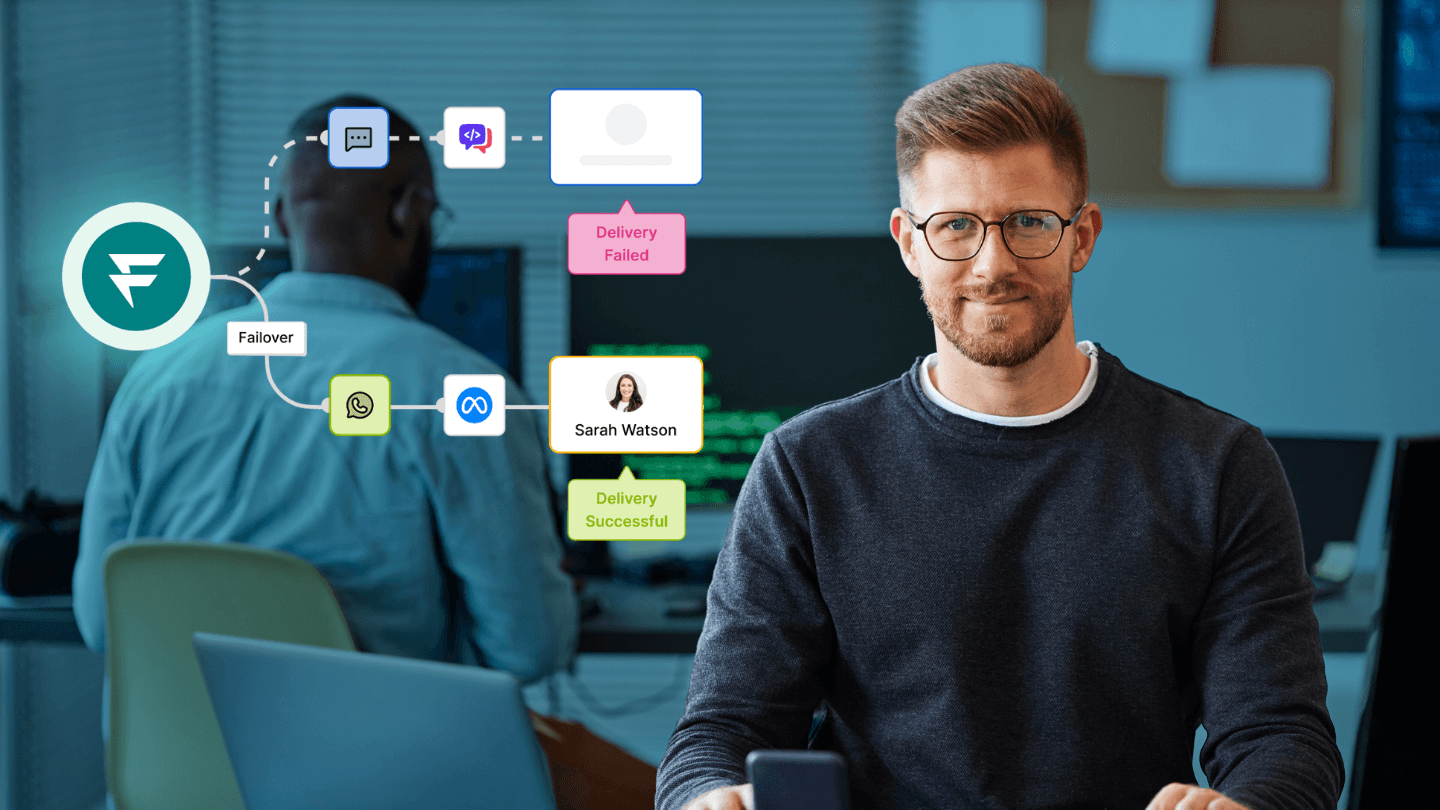

At the same time, the agent monitors the delivery status of the WhatsApp notification. If the status is "pending" for more than a minute, it automatically triggers an SMS as a fallback to ensure this critical transaction information reaches the customer immediately.

This isn't happening yet, but it's the kind of intelligent, proactive communication that AI agents could enable in banking. Beyond just delivering messages, these agents could transform every customer interaction into an opportunity for better service.

Reimagining Banking Communications

Today's bank notification systems mostly operate on if-this-then-that logic. When a transaction occurs, send a confirmation. When a credit card bill is due, send a reminder. When a fixed deposit matures, trigger a renewal notice. While functional, this approach barely scratches the surface of what's possible.

But imagine a system where AI agents work together to make every communication meaningful. These agents wouldn't just deliver information – they'd understand context, anticipate needs, interact with one another and take intelligent action to serve customers better.

What Are AI Agents?

Think of AI agents as specialized digital workers with specific skills and responsibilities.

Unlike traditional automation that simply follows rules, AI agents can learn, make decisions, and take actions autonomously. They're like having a team of smart assistants who understand their domain deeply and can handle complex tasks without constant supervision.

The best part about AI agents is that they can work together. They can share information and coordinate actions to achieve common goals as a team.

Most importantly, they can adapt to new situations, making intelligent decisions based on changing circumstances rather than following fixed rules.

In a banking context, these agents could monitor customer behavior, analyze financial patterns, manage communication channels, and orchestrate personalized interactions – all while ensuring compliance with banking regulations.

How AI agents could transform customer communications in banks?

In the future, technology teams in banks will have a team of AI agents, each performing a specific task.

Here’s how the team would look like:

- A Strategy Agent would analyze vast amounts of customer data to identify opportunities like fixed deposit renewal, credit limit increase, offer a low-interest loan product, etc. And, instead of generic notifications, this agent will craft personalized recommendations based on each customer's financial behavior and goals.

- An Engagement Agent would understand which channel to use, when to use it, and how to communicate. For urgent matters like fraud alerts, it could orchestrate a multichannel communication strategy to ensure immediate attention.

- A Compliance Agent, will ensure every communication adheres to banking regulations. When rules change, it would automatically adjust message templates and delivery protocols. No more manual updates, no more compliance risks.

- And finally, a Resource Agent would manage the infrastructure powering all these communications. By predicting notification volumes and understanding patterns – like month-end transaction spikes or quarterly interest credit messages – it could ensure the system scales seamlessly to handle any load.

A day in the future of banking communications

Let's walk through a typical day where AI agents transform routine banking moments into opportunities for better service.

Early morning, the resource agent automatically scales the infra resources because it is the last working day of the month and companies would be running their payroll during the course of the next few days. This means sending a huge volume of SMS messages to customers.

Around lunchtime, Sarah pays her credit card bill. The Strategy Agent notices she's been using close to 80% of her card limit for the last three months and sends Sarah a notification to increase her credit limit on WhatsApp. Sarah clicks the CTA and increases her credit limit from WhatsApp, without having to open her mobile banking app or having to call her relationship manager.

In the evening, Raj receives his salary. The Strategy Agent notices that Raj has two credit cards that are due on the same date. So, instead of sending a standard credit alert, the strategy agent sends a digest message on WhatsApp, mentioning his salary and also the due date for his cards.

Each interaction is timely, relevant, and personalized. The agents don't just send notifications – they work together to understand customer needs, spot opportunities to help, and communicate in ways that feel natural and helpful.

Making this future a reality

While this level of intelligent communication isn't here yet, the foundation is being laid.

Banks can start preparing by:

- Understanding their current communication patterns and pain points. Which notifications drive value? Where do opportunities for personalization exist? What frustrates customers when they think about your current communications?

- Building a data infrastructure that can support AI agents. These systems will need rich, clean data about customer preferences, behaviors, and interactions to make intelligent decisions.

- Developing clear governance frameworks. As AI agents take on more complex tasks, banks need clear rules about their autonomy and decision-making authority.

The Road ahead

The future of banking communications lies not in sending more messages, but in making each communication count. And, with AI agents, banks could transform routine notifications into opportunities for deeper engagement.

AI agents can help banks move from reactive to proactive communication, and from generic broadcasts to personalized conversations.

Imagine a bank that doesn't just inform you about what happened, but helps you understand what could happen next. A bank that doesn't just send reminders, but provides insights. A bank whose communications feel less like notifications and more like having a personal relationship manager at your fingertips.

This is the promise of AI agents in banking communications. While we're not there yet, the potential is enormous. For banks willing to embrace this vision, the opportunity to reshape customer relationships through intelligent communication awaits.