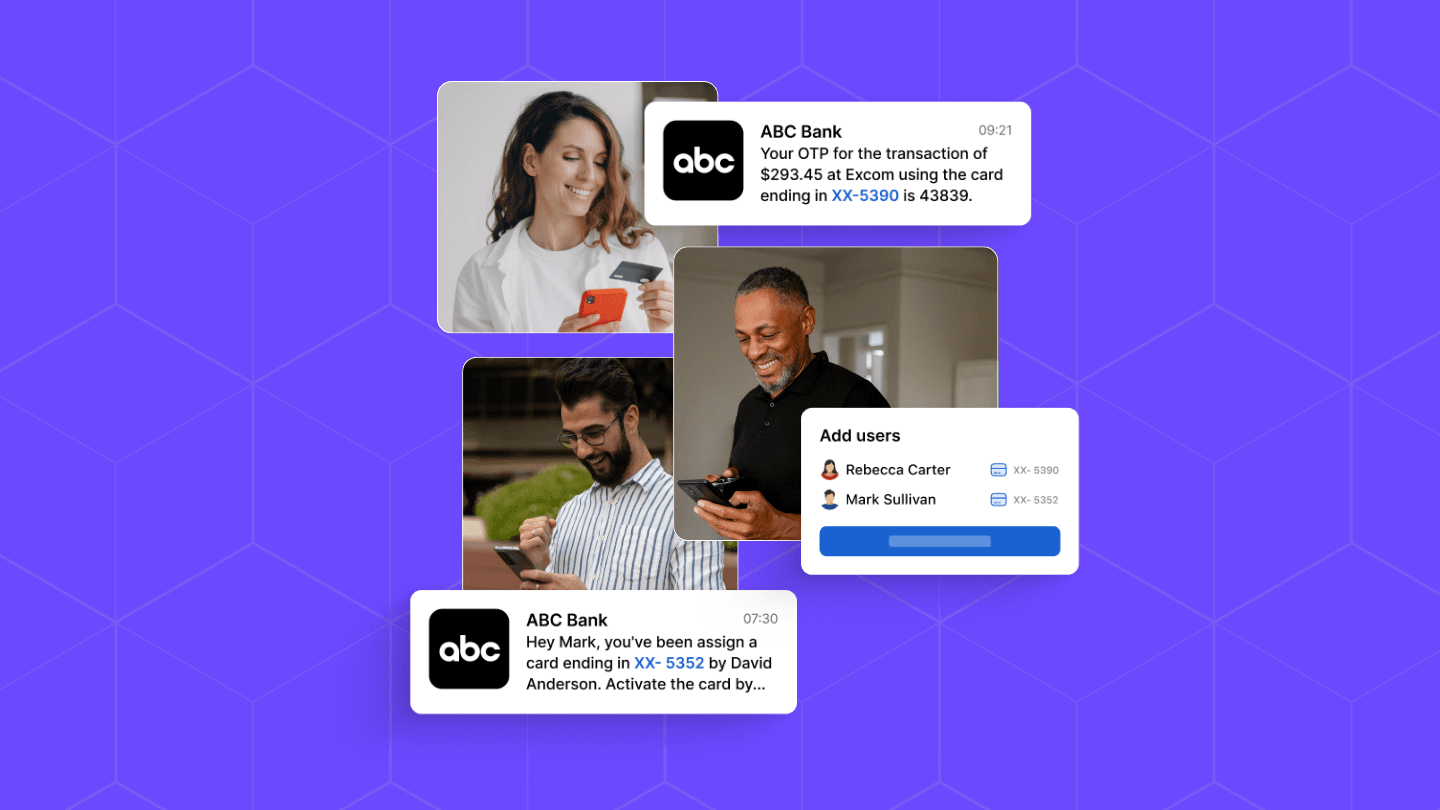

In today's banking landscape, managing multiple payment cards for a single account presents unique challenges.

When several family members or employees hold different cards linked to the same account, communications become unnecessarily complicated. Transaction alerts, security notifications, and one-time passwords (OTPs) often go only to the primary account holder instead of the actual card user, creating frustration and potential security risks.

This is where Fyno offers a simple yet powerful solution for banks, credit unions, neobanks, and fintechs.

The problem with traditional card management

Think about a typical family banking scenario: a primary account holder gets cards for their spouse and adult children. Or consider a business account with cards issued to multiple employees. In both cases, the current system has a critical flaw: all communications go to the primary account holder.

This creates several problems:

- The primary admin must relay OTPs and transaction alerts to each card user, creating delays and inconvenience.

- Card users miss critical updates about their own transactions, potentially missing fraudulent activity.

- These delays create security risks and cause frustration for everyone involved.

Fyno's solution: seamless contact management

Fyno has created a no-code solution that helps financial institutions solve this problem elegantly. The platform allows banks to connect specific contacts with specific cards, ensuring that each card user receives their own notifications directly.

The best part? This solution can be integrated within days, not weeks, without requiring extensive engineering resources.

Key features that make Fyno stand out

Pre-built UI for contact management

Fyno provides a ready-to-use interface that financial institutions can offer their customers. This UI can be:

- Customized to match your banking app's design

- Enhanced with additional security features like two-factor authentication

- Easily expanded with additional attributes as needed

- Monitored through comprehensive audit trails

Smart business logic layer

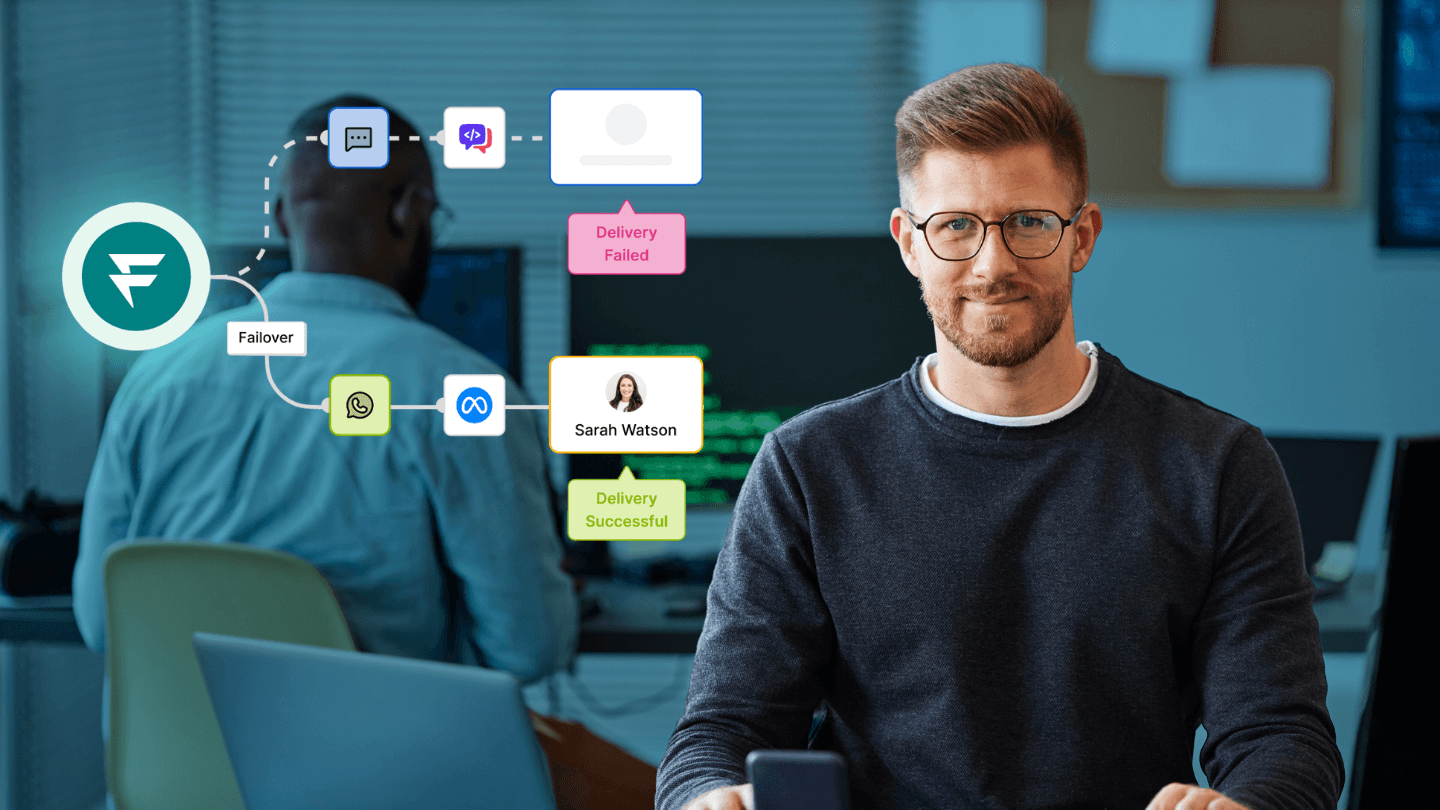

Behind the intuitive interface lies a powerful workflow engine. With Fyno's drag-and-drop no-code builder, banks can create sophisticated wprkflows to:

- Route messages based on user preferences

- Ensure 100% delivery with automated failover protocols

- Sync data from existing systems in real time

This means that when a transaction occurs, the system automatically identifies the associated card user and sends notifications directly to them, not just to the primary account holder.

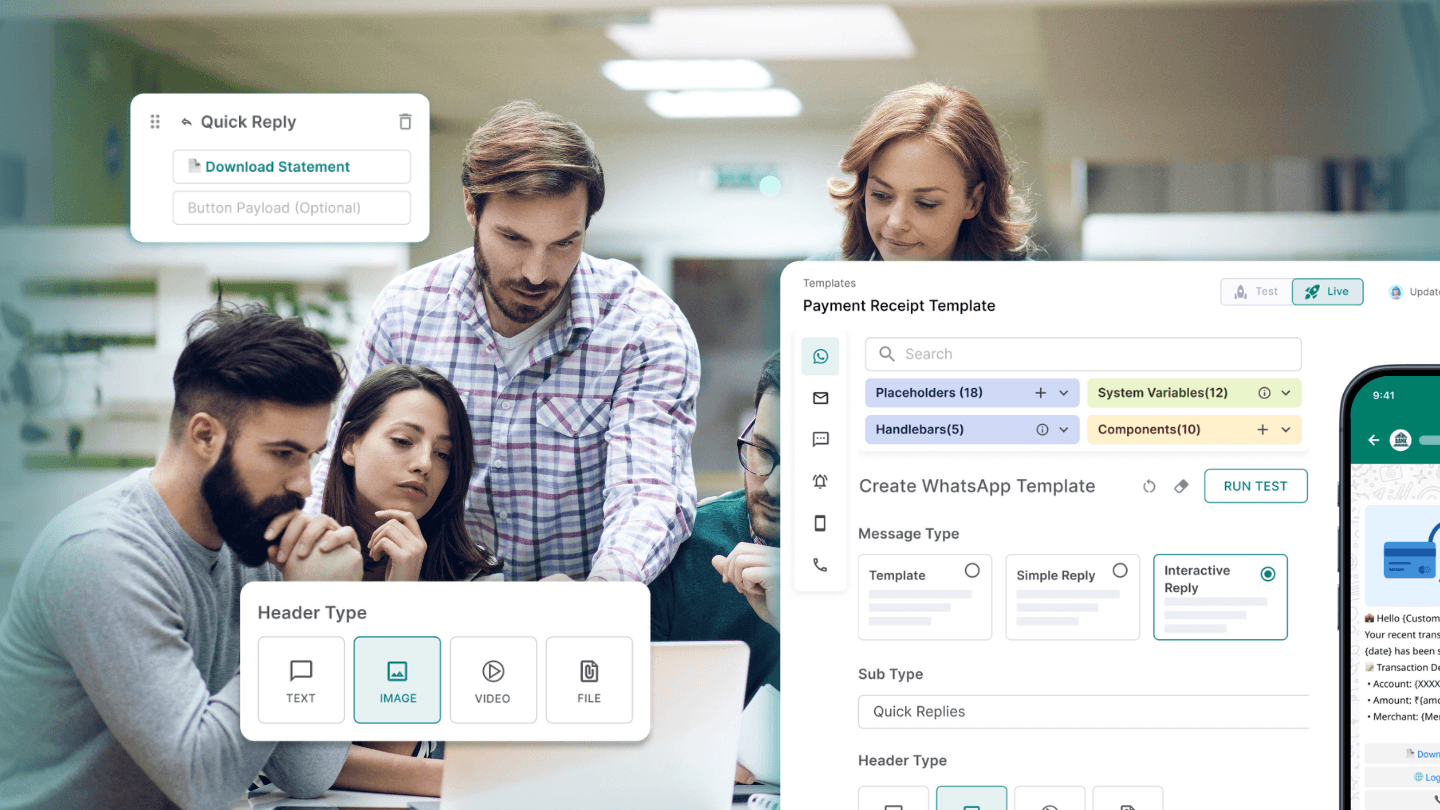

Instant access to new communication channels

Modern customers expect to interact with their financial institutions through their preferred channels. Fyno makes it easy to add emerging channels like WhatsApp and RCS (Rich Communication Services) to your communication workflows.

These channels offer impressive benefits:

- 98% open rates

- 40% higher conversion rates compared to traditional SMS and email

- Immediate reach where customers already spend their time

How it works?

Fyno's architecture connects seamlessly with your existing banking stack:

- Your primary admin can easily assign contacts to specific cards through Fyno's user interface

- When a transaction or security event occurs, your system sends a message trigger to Fyno

- Fyno's workflow layer processes the information, fetches the correct contact data

- The system transforms the data and sends the message through the appropriate channel

- The actual card user receives the notification directly

This process happens instantly, ensuring that important communications reach the right person at the right time.

Benefits for financial institutions

Implementing Fyno's card management solution delivers multiple advantages:

Enhanced security: Each card user receives their own security alerts and OTPs, reducing the risk of fraud.

Improved customer experience: No more frustration from delayed messages or missed notifications.

Reduced support burden: Fewer calls from customers complaining about the failed transactions due to notifications going to the admin

Future-proof technology: Easily add new communication channels as customer preferences evolve.

Rapid implementation: Get up and running in days with minimal engineering effort.

Ready to transform your card management experience?

If your financial institution struggles with the limitations of traditional contact management for your cards, Fyno offers a simple and straightforward solution. By ensuring each card user receives their own communications directly, you can enhance security, improve customer satisfaction, and reduce operational headaches.

The best part is that implementing this solution doesn't require months of development work or extensive technical resources. Fyno's no-code approach means you can integrate this functionality quickly and start seeing benefits immediately.

To learn more about how Fyno can help your institution simplify card management and improve customer communications, reach out to their team at sales@fyno.io to schedule a demo.